At some point, many people face a quiet but important question.

They’ve managed to save some money. Or they’ve freed up a few hours a week. And they start wondering:

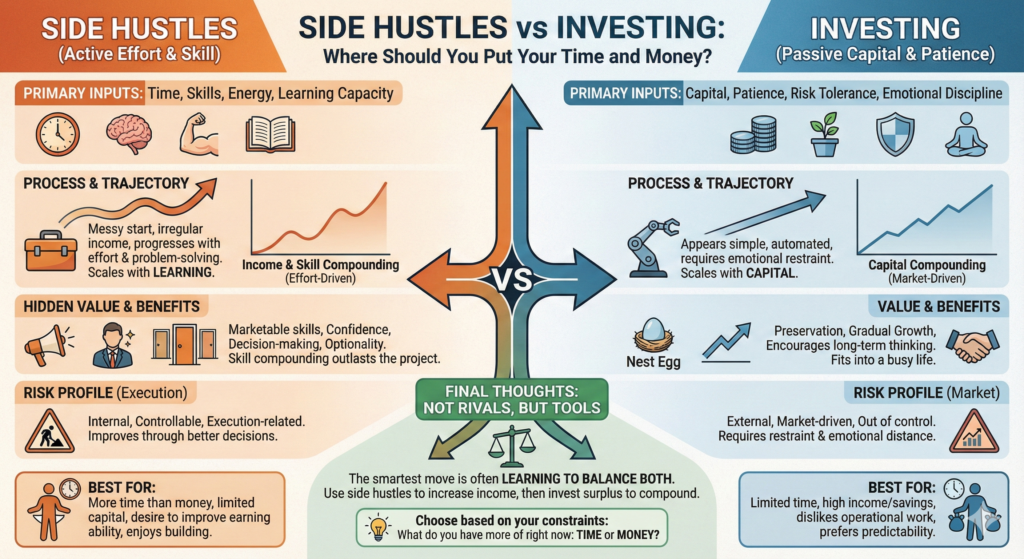

Should I focus on building a side hustle, or should I just invest and let my money work for me?

It’s a reasonable question. And despite what many online discussions suggest, there is no universal answer.

Both paths can make sense. Both have trade-offs. And both can be wrong if chosen for the wrong reasons.

This article explores the difference between side hustles and investing, not as opposing ideas, but as tools that serve different purposes at different stages of life.

First, Let’s Be Honest About the Comparison

Side hustles and investing are often presented as competitors. In reality, they operate on very different mechanics.

A side hustle primarily uses:

- Time

- Skills

- Energy

- Learning capacity

Investing primarily uses:

- Capital

- Patience

- Risk tolerance

- Emotional discipline

Comparing them directly without acknowledging this difference leads to confusion — and bad decisions.

What Investing Actually Offers

Investing is attractive because it appears simple on the surface.

You allocate capital.

You wait.

Returns (hopefully) accumulate over time.

For many people, investing makes sense because:

- It doesn’t require daily effort

- It can be automated

- It fits well into a busy life

- It encourages long-term thinking

Traditional investing, when done conservatively, is often about preservation and gradual growth, not excitement.

From experience, investing works best when expectations are realistic and the strategy is boring enough to stick with.

The Limitations of Investing (Especially Early On)

What is often left unsaid is that investing scales with capital.

If you invest a small amount, the absolute returns will also be small — even if the percentage looks good on paper.

That doesn’t make investing useless. It just means that early on, its impact can feel limited.

Other limitations include:

- Market volatility

- Emotional reactions to drawdowns

- The temptation to chase returns

- Overconfidence during good periods

From experience, investing requires restraint more than intelligence.

What a Side Hustle Actually Offers

A side hustle operates in a very different way.

Instead of capital, it relies on:

- Skills

- Effort

- Problem-solving

- Consistency

A side hustle often starts messy. Income is irregular. Progress is uneven. And results take time.

But side hustles have one major advantage early on:

they scale with effort and learning, not money.

From experience, this makes side hustles especially powerful for people with limited capital but strong motivation.

The Hidden Value of Side Hustles

Most people evaluate side hustles only by income.

That’s a mistake.

Side hustles also build:

- Marketable skills

- Confidence

- Decision-making ability

- Understanding of value creation

- Optionality

Even if a side hustle never becomes a major income source, the skills often outlast the project itself.

From experience, this skill compounding effect is one of the most underestimated benefits.

Risk: Two Very Different Types

Both paths involve risk, but the risk is not the same.

Investing risk is mostly:

- Market-driven

- External

- Often out of your control

Side hustle risk is mostly:

- Execution-related

- Internal

- Largely controllable

A side hustle can fail because of poor decisions — but that also means it can improve through better ones.

From experience, many people feel more comfortable risking time than risking money, especially early on.

Time vs Money: Which Constraint Matters More?

This question matters more than it seems.

If you have:

- Limited time

- High income

- Strong savings

…investing may be the better use of your resources.

If you have:

- More time than money

- Limited capital

- Desire to improve earning ability

…a side hustle often makes more sense.

From experience, frustration often comes from choosing a strategy that doesn’t match your constraints.

The Emotional Side of Both Paths

Investing tests patience.

Side hustles test resilience.

Investing can feel passive and emotionally distant — until markets move against you.

Side hustles feel personal, because effort is directly involved.

Some people prefer the emotional distance of investing.

Others prefer the sense of control that comes with building something themselves.

Neither preference is wrong.

Why “Side Hustles vs Investing” Is the Wrong Framing

The biggest mistake is treating this as an either-or decision.

In reality, the most effective long-term strategies often combine both.

A common pattern looks like this:

- Build a side hustle to increase income

- Use surplus income to invest

- Let investments compound in the background

- Reduce pressure on the side hustle over time

From experience, this combination reduces stress and improves decision quality in both areas.

When Investing First Makes Sense

Focusing on investing first may be the right choice if:

- You already earn enough

- You have limited spare time

- You dislike operational work

- You prefer predictability

In these cases, adding complexity through a side hustle may create more stress than value.

When a Side Hustle First Makes Sense

A side hustle often makes more sense if:

- You want to increase earning potential

- You feel capped by your current income

- You want flexibility

- You enjoy building and learning

From experience, side hustles often create opportunities that investing alone cannot.

Common Mistakes People Make

Some common traps include:

- Expecting investing to replace income quickly

- Treating side hustles like passive income

- Taking excessive financial risk

- Overcommitting time without boundaries

Both paths require discipline — just in different forms.

A Practical Way to Decide

Instead of asking:

“Which one is better?”

Ask:

- What do I have more of right now: time or money?

- What kind of stress can I tolerate?

- Do I want simplicity or control?

- Am I thinking short-term or long-term?

From experience, honest answers lead to better outcomes than chasing the “best” strategy.

Final Thoughts

Side hustles and investing are not rivals.

They are tools — and like all tools, they work best when used appropriately.

Investing helps preserve and grow capital.

Side hustles help build skills, income, and options.

The real advantage comes from understanding when each one makes sense in your life.

Choosing the right path at the right time matters more than choosing the “correct” path in theory.

And often, the smartest move is not choosing one — but learning how to balance both.