Earning extra money through a side hustle feels like progress. And it is.

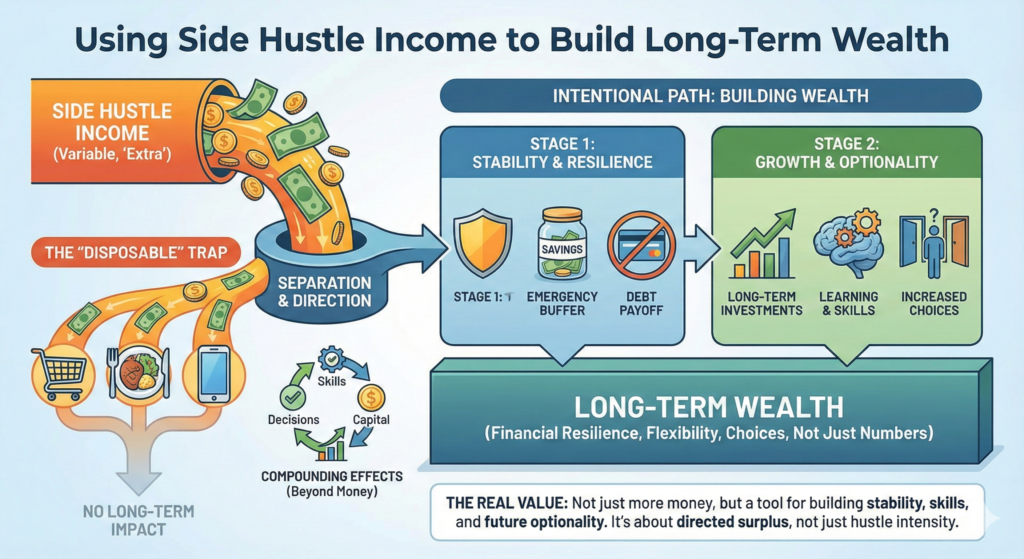

But what really determines the long-term impact of a side hustle is not how much it earns, but what you do with that income once it arrives.

Many people start side hustles, make some extra money, and yet see very little change in their financial situation years later. Others earn modest amounts but manage to build real financial resilience over time.

The difference is not hustle intensity.

It’s how side hustle income is used and integrated into a long-term plan.

Why Side Hustle Income Is Different From Salary

Side hustle income behaves differently from regular salary.

It is often:

- Irregular

- Variable

- Mentally framed as “extra”

- Less emotionally attached to fixed expenses

This difference matters.

Because side hustle income doesn’t feel essential at first, it creates an opportunity: you can assign it a purpose instead of reacting to it.

From experience, people who treat side hustle income deliberately tend to extract far more long-term value from it than those who simply let it blend into daily spending.

The First Mistake: Treating Side Hustle Income as Disposable

One of the most common mistakes is viewing side hustle income as “bonus money.”

When income feels like a bonus, it often goes toward:

- Impulse spending

- Lifestyle upgrades

- Unplanned expenses

- Short-term rewards

There’s nothing wrong with enjoying some of the money. The problem arises when all of it disappears without strengthening your financial position.

From experience, side hustle income that leaves no trace rarely changes outcomes.

Wealth Is Built Through Direction, Not Amount

Long-term wealth is not built by income alone. It’s built by directed surplus.

Even small amounts, when used consistently and intentionally, can:

- Reduce vulnerability

- Increase optionality

- Create momentum

Side hustle income is powerful precisely because it can be directed without threatening basic stability.

It doesn’t need to replace your salary to matter.

Step One: Create Separation

A practical first step is separation.

This doesn’t require complexity — just clarity.

Separation might mean:

- A dedicated account

- A clear mental boundary

- Simple tracking of side income and usage

From experience, separation changes behavior. When income is visible and distinct, it’s easier to make intentional decisions instead of default ones.

Step Two: Decide the Role of the Income

Before worrying about investments or returns, decide what the income is for.

Common roles include:

- Building an emergency buffer

- Paying down high-interest debt

- Funding long-term investments

- Creating optionality (time, flexibility, choices)

The role can change over time, but it should never be undefined.

From experience, undefined money tends to vanish.

Stability Comes Before Growth

Many people rush to invest side hustle income before addressing fragility.

But long-term wealth depends on stability first.

Using side hustle income to:

- Build an emergency fund

- Smooth cash flow

- Reduce reliance on credit

…may not feel exciting, but it dramatically improves financial resilience.

From experience, people who skip this step often end up pulling money back out later during stressful periods.

Side Hustle Income as a Learning Tool

Another overlooked benefit is learning.

Side hustle income can be used to:

- Learn basic investing concepts

- Practice long-term thinking

- Experience volatility with small stakes

- Develop emotional discipline

From experience, learning with side hustle income often feels safer than learning with core savings, because the psychological pressure is lower.

This makes it an excellent training ground for better financial decisions later.

Avoid the Trap of Over-Optimization

It’s easy to become obsessed with maximizing returns.

But early on, optimization matters less than consistency and survival.

Common mistakes include:

- Overcomplicating strategies

- Chasing returns

- Constantly changing approaches

- Ignoring time and stress costs

From experience, boring consistency beats clever complexity in the long run.

How Side Hustles Create Compounding Effects

Side hustles compound in more ways than one.

They compound through:

- Skill improvement

- Better decision-making

- Capital accumulation

- Confidence and optionality

The money earned is only one layer.

The habits and perspective developed often matter more.

From experience, people who use side hustle income intentionally tend to make better financial decisions across the board — even outside the hustle itself.

When Reinvestment Makes Sense

Reinvesting side hustle income back into the hustle can make sense — but only with boundaries.

Reinvestment is useful when it:

- Improves efficiency

- Reduces time demands

- Strengthens systems

- Increases sustainability

Reinvestment becomes risky when it:

- Increases stress

- Adds complexity

- Raises fixed costs too early

From experience, reinvesting cautiously preserves flexibility.

Wealth Is About Optionality, Not Just Numbers

A key shift in long-term thinking is redefining wealth.

Wealth is not just net worth.

It’s the ability to choose.

Side hustle income contributes to wealth when it:

- Reduces dependency

- Increases negotiating power

- Creates time flexibility

- Expands future options

From experience, this form of wealth often arrives quietly, long before it’s visible on paper.

The Long View Matters More Than Monthly Results

Monthly side hustle income can fluctuate. That’s normal.

What matters is the trend:

- Are you more stable than last year?

- Do you have more options?

- Are decisions less stressful?

- Is your system improving?

From experience, people who evaluate progress annually rather than monthly make calmer, better long-term decisions.

Common Pitfalls to Watch For

Some patterns consistently undermine long-term results:

- Treating side hustle income casually

- Scaling expenses alongside income

- Ignoring taxes and structure

- Measuring success only by short-term gains

Awareness alone avoids many of these traps.

A Simple Framework That Works

A realistic framework looks like this:

- Separate side hustle income

- Assign it a clear role

- Build stability first

- Use surplus intentionally

- Review periodically and adjust

This framework is simple on purpose. Complexity can come later — if it’s needed at all.

Final Thoughts

Side hustles create opportunity.

But opportunity only becomes wealth when it’s handled with intention.

Using side hustle income well doesn’t require extreme discipline or perfect strategy. It requires clarity, patience, and a willingness to think beyond the next month.

The goal isn’t to turn a side hustle into instant wealth.

The goal is to let small, repeatable decisions compound quietly over time.

That’s how side hustle income stops being “extra” — and starts becoming structural.