One of the first questions that comes up once a side hustle starts making money is deceptively simple:

How much of this should I reinvest?

Online, the answers are often extreme.

Some say you should reinvest everything.

Others argue you should take profits immediately and never look back.

In practice, both approaches tend to fail for the same reason:

they ignore context.

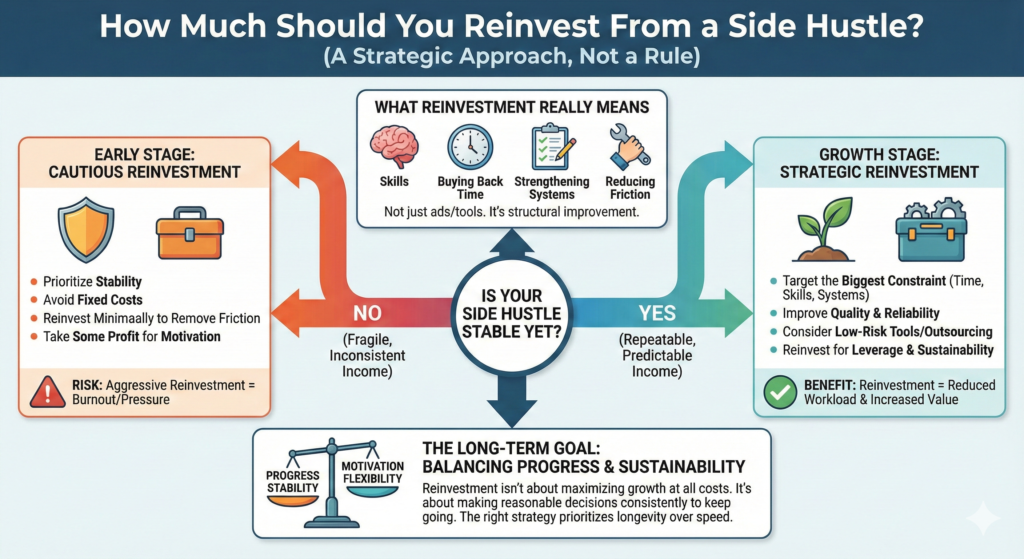

Reinvestment is not a rule. It’s a decision that depends on stage, stability, and personal constraints.

This article looks at how to think about reinvesting side hustle income in a realistic, sustainable way — without hype and without formulas that don’t survive real life.

First, What Does “Reinvesting” Really Mean?

Reinvesting doesn’t only mean spending money on ads or tools.

In the context of a side hustle, reinvestment can include:

- Improving skills

- Buying back time

- Strengthening systems

- Reducing friction

- Increasing sustainability

Sometimes the best reinvestment isn’t financial at all — it’s structural.

From experience, people who define reinvestment too narrowly often overspend early and regret it later.

The Most Common Mistake: Reinvesting Too Early

One of the biggest mistakes is reinvesting aggressively before the side hustle proves itself.

Early-stage side hustles are fragile.

Income is inconsistent.

The model may still change.

Reinvesting heavily at this stage can:

- Increase pressure

- Reduce flexibility

- Lock you into decisions too soon

From experience, early reinvestment often feels productive — but it can quietly raise the risk of burnout or abandonment.

Stability Comes Before Scaling

Before deciding how much to reinvest, a more important question is:

Is this side hustle stable yet?

Signs of stability include:

- Repeatable income

- Predictable effort-to-reward ratio

- Clear understanding of what creates results

- Manageable time demands

If these elements aren’t in place, reinvestment should be conservative.

From experience, scaling instability rarely ends well.

The Role of Personal Finances in Reinvestment Decisions

Reinvestment decisions don’t happen in isolation.

They are deeply influenced by:

- Emergency savings

- Debt levels

- Income reliability

- Stress tolerance

If side hustle income is needed to:

- Build a safety buffer

- Reduce financial anxiety

- Cover irregular expenses

…then reinvesting aggressively may not be the right move.

From experience, financial pressure leads to worse business decisions — not better ones.

Why “Reinvest Everything” Often Backfires

The idea of reinvesting 100% of profits sounds disciplined and ambitious.

In reality, it often creates problems:

- No reward for effort

- Increased frustration

- Loss of motivation

- Rising expectations without margin

Side hustles require energy. Energy requires some form of reinforcement.

From experience, people who never allow themselves to benefit from side hustle income often burn out — even if the numbers look good on paper.

The Psychological Importance of Taking Some Profit

Taking profit is not a failure of discipline.

It’s a signal.

It reminds you:

- Why you started

- That effort leads to reward

- That progress is real

This doesn’t mean spending irresponsibly. It means acknowledging progress.

From experience, even small, intentional rewards help sustain long-term consistency.

A More Useful Way to Think About Reinvestment

Instead of asking:

“How much should I reinvest?”

Ask:

“What is the biggest constraint right now?”

Common constraints include:

- Time

- Skill gaps

- Inefficient processes

- Mental overload

The best reinvestment often targets the primary bottleneck, not growth for its own sake.

From experience, removing friction beats chasing expansion early on.

When Reinvestment Makes the Most Sense

Reinvestment becomes more valuable when:

- Income is consistent

- The model is clear

- Systems are repeatable

- Time is the main limitation

At this stage, reinvestment can:

- Reduce workload

- Improve quality

- Increase sustainability

- Create leverage

From experience, reinvesting at the right moment feels relieving, not stressful.

Types of Reinvestment That Tend to Pay Off

Some forms of reinvestment tend to be lower risk:

- Education tied to immediate application

- Tools that save time

- Outsourcing repetitive tasks

- Improving reliability and quality

Higher-risk reinvestments include:

- Aggressive advertising

- Fixed recurring costs

- Premature scaling

- Complex tools with steep learning curves

From experience, reinvestment should simplify the side hustle — not complicate it.

Why Percentages Can Be Misleading

Many people look for a fixed percentage:

“Should I reinvest 30%? 50%? 80%?”

Percentages feel precise, but they hide reality.

A better approach is:

- Fixed minimum for stability

- Flexible surplus for reinvestment

- Occasional rewards to sustain motivation

From experience, rigid rules adapt poorly to fluctuating income.

Reinvestment Over Time: It Should Change

Reinvestment is not a one-time decision.

Early on:

- Reinvestment should be minimal and cautious

As stability increases:

- Reinvestment can grow selectively

Later:

- Reinvestment becomes strategic, not reactive

From experience, people who adjust reinvestment over time avoid both stagnation and exhaustion.

The Cost of Not Reinvesting at All

While over-reinvestment is common, under-reinvestment has costs too.

Not reinvesting at all can lead to:

- Stagnation

- Inefficiency

- Frustration

- Missed opportunities

The goal is not zero reinvestment — it’s intentional reinvestment.

How Reinvestment Affects Long-Term Wealth

Reinvestment choices shape more than short-term income.

They influence:

- Skill accumulation

- Time freedom

- Optionality

- Sustainability

From experience, the most valuable reinvestments are often invisible on a monthly income chart — but obvious years later.

A Simple, Realistic Framework

A practical framework that works for many people:

- Use side hustle income to support stability first

- Reinvest to remove the biggest constraint

- Take some profit intentionally

- Avoid fixed costs early

- Review decisions periodically

This framework prioritizes longevity over speed.

Final Thoughts

Reinvesting from a side hustle is not about maximizing growth at all costs.

It’s about balancing:

- Progress

- Stability

- Motivation

- Flexibility

The right reinvestment strategy is the one that allows you to keep going — not the one that looks best in theory.

Side hustles succeed not because people reinvest aggressively, but because they make reasonable decisions consistently over time.

And in the long run, that consistency matters far more than any single percentage.