One of the most common misconceptions about crypto side hustles is that any profitable activity can be scaled.

If it works with small amounts, people assume it will work with more time, more capital, or more effort. In practice, crypto doesn’t behave that way.

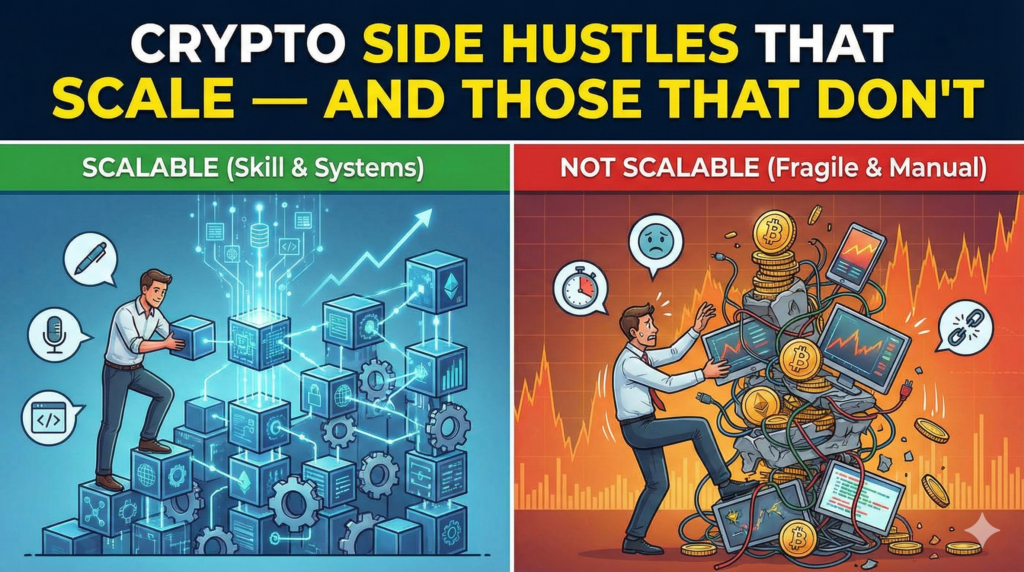

Some crypto side hustles scale relatively well.

Others break down the moment you try to grow them.

Understanding the difference early can save time, money, and frustration.

This article looks at which crypto side hustles tend to scale, which ones don’t, and why that distinction matters far more than short-term results.

What “Scaling” Really Means in Crypto

Scaling is often misunderstood as “making more money.”

In reality, scaling means:

- Increasing output without proportional increases in stress

- Maintaining efficiency as size grows

- Preserving decision quality under higher stakes

- Keeping risk manageable as exposure increases

A crypto side hustle that earns more but becomes harder, riskier, or mentally exhausting is not truly scaling — it’s just getting bigger.

From experience, many crypto activities confuse growth with scalability.

Why Crypto Side Hustles Break When They Grow

Crypto environments are fragile.

Many strategies rely on:

- Low liquidity

- Temporary inefficiencies

- Early access

- Incentives that disappear

- Rules that can change overnight

When size increases, these fragilities become visible.

A side hustle that works at a small scale may fail because:

- Slippage increases

- Attention becomes harder to manage

- Errors become more expensive

- Platforms impose limits

- Competition reacts

From experience, crypto side hustles often fail not because they stop working — but because they don’t survive growth.

Crypto Side Hustles That Tend to Scale Better

Some crypto side hustles scale relatively well because they rely on skills and systems, not market timing.

Examples include:

- Educational content and research

- Writing, editing, or analysis

- Community management at scale

- Technical documentation

- Advisory or consulting roles (non-promotional)

- Infrastructure-related services

These activities scale because:

- Time can be leveraged

- Reputation compounds

- Income is not tied to price direction

- Risk remains mostly operational

From experience, these side hustles feel slower early on, but become more stable over time.

Why Skill-Based Crypto Work Scales More Safely

Skill-based crypto side hustles scale because:

- Demand grows with credibility

- Output improves with experience

- Mistakes are reversible

- Capital exposure is limited

Growth comes from:

- Better positioning

- Stronger networks

- Clearer communication

- Trust built over time

From experience, this kind of scalability feels less exciting — but far more durable.

Crypto Side Hustles That Struggle to Scale

Many crypto side hustles struggle when pushed beyond a certain point.

Common examples include:

- Manual trading

- Arbitrage across small venues

- Incentive farming

- Timing-based strategies

- High-frequency decision models

These often fail to scale because:

- Edge disappears with size

- Execution becomes harder

- Stress increases disproportionately

- Capital amplifies mistakes

From experience, what works with small capital often becomes fragile with larger exposure.

The Attention Bottleneck

One of the biggest scaling limits in crypto is attention.

As scale increases:

- Monitoring becomes constant

- Decisions feel heavier

- Mistakes carry emotional weight

- Cognitive fatigue builds

A side hustle may scale financially but collapse psychologically.

From experience, attention is often the real bottleneck — not strategy.

Platform Risk Grows With Scale

Platform risk is manageable at small scale.

At larger scale, it becomes critical.

Scaling increases exposure to:

- Rule changes

- Liquidity freezes

- Account restrictions

- Technical failures

- Counterparty risk

From experience, platform dependence becomes more dangerous as size grows — especially in crypto, where recourse is limited.

Why Automation Doesn’t Always Solve the Problem

Automation is often seen as the solution to scalability.

In crypto, automation can help — but it introduces new risks:

- Technical failures

- Hidden bugs

- Overconfidence

- Reduced situational awareness

From experience, automation scales execution, but it also scales mistakes.

Scalability improves only when automation reduces friction without increasing fragility.

A Simple Test for Scalability

A useful way to assess scalability is to ask:

- Does this require constant attention?

- Do mistakes become more costly as it grows?

- Does growth depend on conditions I don’t control?

- Can this survive lower margins?

- Would I still do this at double the size?

From experience, honest answers to these questions reveal more than performance metrics.

When a Non-Scalable Hustle Is Still Worth It

Not every side hustle needs to scale.

Some crypto side hustles are valuable because they:

- Generate temporary income

- Teach market awareness

- Build experience

- Fill a specific phase of life

The problem is not non-scalability.

The problem is expecting scalability where none exists.

From experience, frustration often comes from misaligned expectations, not bad strategies.

Redefining “Success” in Crypto Side Hustles

Success doesn’t always mean growth.

Sometimes success means:

- Knowing when to stop

- Keeping exposure controlled

- Preserving mental energy

- Using skills elsewhere

- Avoiding unnecessary risk

From experience, restraint is often the difference between sustainable involvement and burnout.

How Scalability Should Influence Your Choices

Scalability should inform:

- How much time you invest

- How much capital you risk

- How seriously you build systems

- How long you plan to stay involved

A side hustle that doesn’t scale should be treated differently from one that does.

From experience, mismatched commitment leads to poor decisions.

Final Thoughts

Crypto side hustles vary widely in how they scale.

Some grow stronger with time and experience.

Others weaken as size increases.

The mistake is not choosing the “wrong” type.

The mistake is ignoring scalability altogether.

In crypto, the best long-term outcomes often come from:

- Modest expectations

- Clear boundaries

- Skill-driven value

- Controlled exposure

Scalability is not about how fast you grow.

It’s about whether growth makes your life better — or harder.