Not all crypto side hustles are created equal.

They’re often discussed as if they belonged to the same category, but in reality, crypto-related side hustles sit on a very wide spectrum of risk. Some behave more like technical services or educational work. Others are deeply tied to market volatility, timing, and capital exposure.

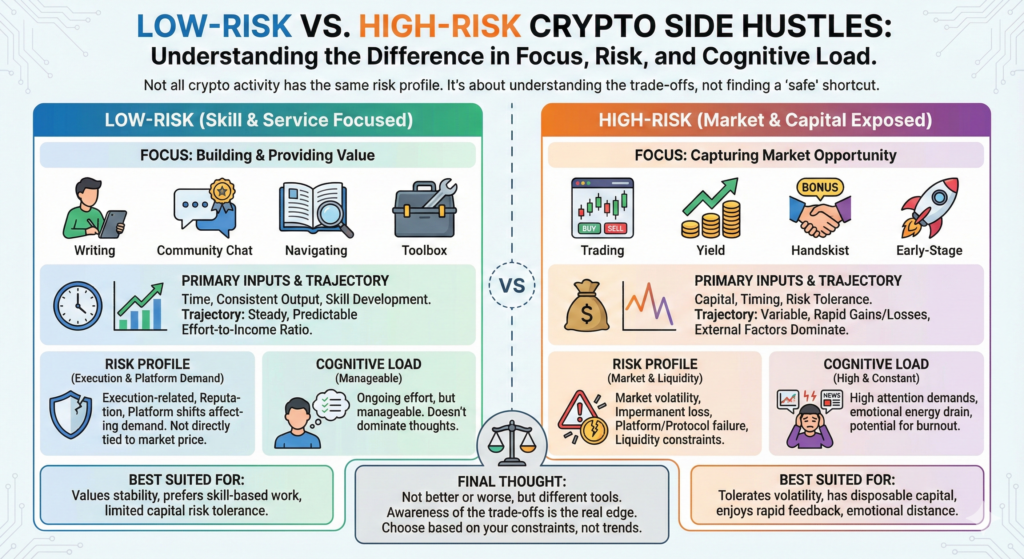

Understanding the difference between low-risk and high-risk crypto side hustles is not about avoiding crypto altogether. It’s about knowing what kind of risk you’re actually taking, and whether that risk matches your goals, resources, and tolerance.

This article breaks down that distinction in a practical, grounded way — without hype and without pretending there’s a “safe” shortcut.

Why Risk in Crypto Is Often Misunderstood

When people hear “crypto risk,” they usually think about price volatility.

That’s part of the picture, but not the whole story.

In crypto side hustles, risk can come from:

- Market exposure

- Platform dependency

- Regulatory uncertainty

- Liquidity constraints

- Technical complexity

- Human error

Two crypto side hustles can both involve blockchain technology and yet carry completely different risk profiles.

From experience, confusion comes from treating all crypto activity as if it had the same risk structure.

What Low-Risk Crypto Side Hustles Actually Look Like

Low-risk crypto side hustles tend to minimize direct exposure to price movements.

They usually focus on:

- Skills

- Services

- Knowledge

- Infrastructure

- Education

Examples include:

- Writing or editing crypto-related content

- Managing communities or moderation

- Educational content or research

- Technical support or documentation

- Advisory or analytical roles (non-promotional)

The key characteristic is this:

income is not directly dependent on market direction.

From experience, these side hustles feel closer to traditional digital work — with crypto as the context, not the source of risk.

Why Low-Risk Doesn’t Mean No Effort

Low-risk crypto side hustles are often misunderstood as “easy.”

They’re not.

They usually require:

- Consistent output

- Ongoing learning

- Clear communication

- Reputation over time

The risk is lower financially, but the effort is real.

From experience, people who underestimate the work involved in low-risk crypto roles tend to quit early — not because of losses, but because expectations were wrong.

What High-Risk Crypto Side Hustles Involve

High-risk crypto side hustles are typically tied directly to markets or incentives.

They may include:

- Active trading

- Arbitrage

- Yield strategies

- Incentive-based participation

- Early-stage protocol exposure

In these cases:

- Capital is at risk

- Outcomes are variable

- Timing matters

- External factors dominate results

From experience, these hustles can produce results quickly — but they can also reverse just as fast.

Why High-Risk Hustles Feel More Attractive

High-risk crypto side hustles often feel more exciting.

They offer:

- Faster feedback

- Visible numbers

- Clear wins and losses

- A sense of being “in the market”

That emotional engagement can be motivating — especially early on.

But emotional intensity is not the same as sustainability.

From experience, excitement often masks how fragile these strategies really are over time.

The Risk That Isn’t Talked About Enough

One overlooked risk in high-risk crypto side hustles is cognitive load.

Monitoring markets, managing positions, reacting to news — all of this consumes attention and emotional energy.

A side hustle may be profitable on paper, but costly in practice if:

- It dominates your thoughts

- It disrupts sleep or focus

- It affects unrelated decisions

From experience, this invisible cost often matters more than short-term returns.

Platform and Protocol Risk

Both low-risk and high-risk crypto side hustles can depend on platforms — but the impact differs.

In low-risk roles:

- Platform changes may reduce demand

- Income may fluctuate gradually

In high-risk roles:

- Platform changes can wipe out a strategy overnight

- Rules can change without warning

- Capital can become stuck or illiquid

From experience, platform dependence magnifies risk — especially when capital is involved.

How Time Changes the Risk Profile

Risk in crypto side hustles is not static.

What starts as:

- Low competition

- Clear inefficiencies

- Favorable incentives

…often evolves into:

- Crowded environments

- Compressed margins

- Higher complexity

From experience, many crypto side hustles become riskier over time, not safer — even if the strategy itself doesn’t change.

Choosing Based on Constraints, Not Trends

The best choice is rarely about which side hustle looks better online.

It’s about constraints.

Low-risk crypto side hustles tend to suit people who:

- Want predictable effort-to-income ratios

- Prefer skill-based work

- Have limited risk tolerance

- Value stability

High-risk crypto side hustles tend to suit people who:

- Can tolerate volatility

- Have capital they can afford to lose

- Enjoy rapid feedback

- Can disengage emotionally

From experience, mismatches between constraints and strategy cause more problems than lack of knowledge.

Mixing Both: A Common but Risky Approach

Some people try to combine low-risk and high-risk crypto hustles simultaneously.

This can work — but only with clear boundaries.

Problems arise when:

- Profits from low-risk work fund uncontrolled risk

- Emotional spillover affects decision-making

- Time and attention become fragmented

From experience, mixing approaches without structure often increases stress without improving results.

A Better Way to Think About “Risk”

Instead of asking:

“Is this low-risk or high-risk?”

Ask:

- What am I risking exactly?

- How reversible is this decision?

- How much attention does it require?

- What happens if this stops working?

From experience, reversibility is one of the most important — and ignored — dimensions of risk.

When a High-Risk Hustle No Longer Makes Sense

High-risk crypto side hustles often stop making sense when:

- Capital requirements grow

- Margins shrink

- Stress increases

- Learning plateaus

- Opportunity cost rises

Recognizing this early prevents unnecessary losses — financial and psychological.

Final Thoughts

Low-risk and high-risk crypto side hustles are not better or worse by default.

They are tools with different trade-offs.

Low-risk hustles favor stability, skills, and endurance.

High-risk hustles favor timing, discipline, and emotional control.

The mistake is not choosing one over the other.

The mistake is choosing without understanding what kind of risk you’re actually taking.

In crypto, awareness is the real edge — not speed, not leverage, and not optimism.