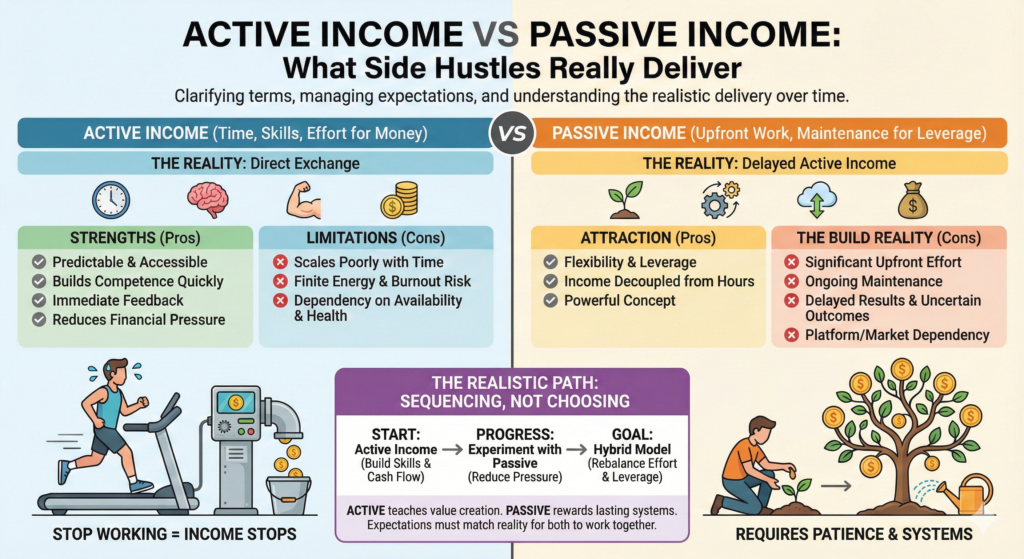

Few topics generate as much confusion — and unrealistic expectations — as active income versus passive income.

Scroll through social media or blogs for a few minutes and you’ll quickly see promises of “passive income streams” that supposedly generate money while you sleep. At the same time, active income is often portrayed as something inferior, exhausting, or outdated.

Reality, as usual, is more nuanced.

This article looks at active income and passive income in the context of side hustles, not to sell an idea, but to clarify what these terms actually mean — and what they realistically deliver over time.

First, Let’s Remove the Fantasy

Purely passive income is rare.

In most cases, what people call “passive income” is better described as delayed active income. Effort is required upfront — sometimes a lot of it — before income becomes more predictable or hands-off.

Understanding this distinction matters, because disappointment usually comes from mismatched expectations, not bad strategies.

What Active Income Really Is

Active income is straightforward.

You exchange:

- Time

- Skills

- Effort

…for money.

In the context of side hustles, active income usually includes:

- Freelancing

- Consulting

- Teaching or tutoring

- Service-based work

- Contract or project work

The defining feature is simple:

If you stop working, income stops too.

That doesn’t make active income bad. It makes it clear and honest.

The Strengths of Active Income

Active income has several advantages that are often overlooked.

First, it’s predictable.

You know when you work and what you’ll earn.

Second, it’s accessible.

You usually don’t need capital to start — just skills and time.

Third, it builds competence quickly.

Active income forces feedback. You learn what people value, what they’re willing to pay for, and where your weak points are.

From experience, active income is often the fastest way to:

- Increase income short term

- Learn marketable skills

- Build confidence

- Reduce financial pressure

The Limitations of Active Income

The downside is also clear.

Active income scales poorly with time.

There are only so many hours in a day, and energy is finite. Over time, this can lead to fatigue or burnout if boundaries are not set.

Active income also creates dependency:

- On your availability

- On your health

- On your capacity to perform

This doesn’t make it a bad strategy — it simply means it has natural limits.

What Passive Income Actually Looks Like

Passive income is usually described as money earned with little ongoing effort.

In reality, most passive income streams involve:

- Significant upfront work

- Ongoing maintenance

- Periodic decision-making

Examples in the side hustle world include:

- Content monetized with ads or affiliates

- Digital products

- Automated services

- Royalties or licensing

- Long-term investments tied to systems

The “passive” part comes later — and often only partially.

Why Passive Income Is So Attractive

Passive income appeals to people for understandable reasons.

It promises:

- Flexibility

- Leverage

- Income decoupled from hours worked

The idea of earning without constant effort is powerful, especially for people who feel time-constrained or burned out.

But attraction is not the same as suitability.

The Reality of Building Passive Income

What is often missing from the conversation is how passive income is built.

Most passive income streams start as:

- Active work

- With delayed results

- And uncertain outcomes

From experience, people who succeed with passive income usually:

- Treat it like a business

- Stay consistent longer than expected

- Accept slow progress early on

Those who expect immediate passivity tend to quit early.

Risk: Different, Not Lower

Passive income is often marketed as “lower risk,” but the risk is simply different.

Active income risk:

- Physical exhaustion

- Time constraints

- Income tied to presence

Passive income risk:

- Time invested without returns

- Platform dependency

- Market or algorithm changes

- Delayed feedback

From experience, passive income feels safer emotionally — until results don’t appear.

Which One Is Better for Side Hustles?

This is where most articles oversimplify.

Active income is usually better at the beginning.

Passive income becomes more attractive later.

Why?

Because active income:

- Generates cash flow quickly

- Builds skills

- Reduces financial pressure

Passive income:

- Requires patience

- Benefits from experience

- Works better with margin and capital

From experience, trying to build passive income without skills, patience, or financial buffer often leads to frustration.

The Path Most People Don’t Talk About

The most realistic path is not choosing one over the other — it’s sequencing.

A common progression looks like this:

- Start with active income

- Build skills and cash flow

- Reduce pressure and urgency

- Experiment with passive income

- Gradually rebalance effort and leverage

This approach aligns expectations with reality.

Why “Passive First” Is Often a Mistake

Starting with passive income sounds appealing, but it often fails because:

- Feedback is slow

- Motivation drops

- Learning feels abstract

- Progress is hard to measure

Active income provides immediate signals:

clients, payments, feedback, improvement.

From experience, those signals matter more early on than long-term leverage.

Psychological Differences That Matter

Active income tests discipline and energy.

Passive income tests patience and belief.

Some people enjoy visible progress. Others prefer quiet compounding.

Understanding your own psychology matters more than following trends.

How Side Hustles Actually Blend Both

Most successful side hustles are hybrids.

For example:

- Active services that lead to digital products

- Content paired with consulting

- Teaching combined with scalable resources

The line between active and passive becomes less important than how effort converts into value over time.

A Better Question to Ask

Instead of asking:

“Should I focus on active or passive income?”

Ask:

- What do I need right now?

- How much uncertainty can I tolerate?

- Do I need cash flow or leverage?

- Am I optimizing for this year or the next five?

From experience, good answers come from self-awareness, not trends.

Final Thoughts

Active income and passive income are not opposing forces.

They are phases, tools, and trade-offs.

Active income teaches you how value is created.

Passive income rewards you for building systems that last.

The problem isn’t choosing the wrong one.

The problem is expecting either to behave like the other.

When expectations match reality, both approaches can work — especially when used together, intentionally and patiently.