For the better part of a decade, the “dropshipping” narrative has been the gateway drug to entrepreneurship. The pitch, perpetuated by YouTube gurus renting Lamborghinis for the weekend, was seductively simple: find a cheap product on AliExpress, set up a Shopify store, run some Facebook ads, and pocket the difference. It was portrayed as the ultimate geographic and financial freedom—a business with no inventory, no risk, and infinite upside.

In 2016, this model worked. It worked because the internet was inefficient. There was a massive gap between Western consumer demand and Chinese manufacturing supply, and the dropshipper acted as the bridge.

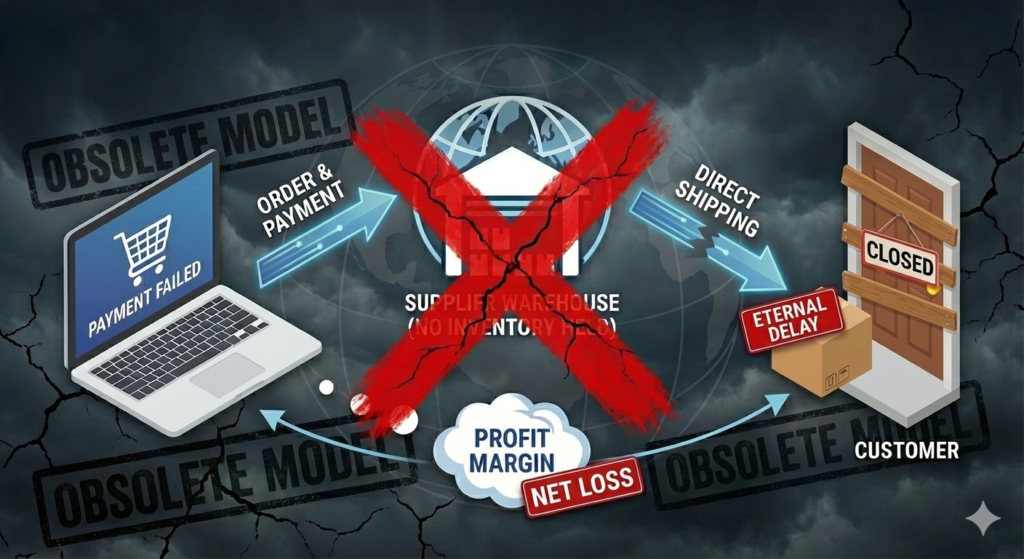

However, as we navigate 2025, the bridge has collapsed. The failure rate for new dropshipping stores is now estimated to be over 90% within the first 120 days. This mass extinction event is not due to a lack of effort or a lack of “winning products.” It is a fundamental collapse of the business model’s unit economics. The era of “Information Arbitrage”—buying low from a supplier nobody knows and selling high to a customer who doesn’t know better—is officially over.

To understand why dropshippers are failing, we must look beyond the hype and analyze the cold, hard data of margins, acquisition costs, and supply chain transparency.

The Compression of Margins: The CAC Crisis

The single biggest killer of the modern dropshipping store is the Cost of Customer Acquisition (CAC). In the “Golden Era” of 2017, Facebook CPMs (Cost Per Mille, or cost per 1,000 impressions) were dirt cheap. You could acquire a customer for $5 and sell them a $20 product with a product cost of $4. The math was undeniably attractive.

In 2025, the advertising landscape has matured into a ruthlessly efficient marketplace. Large conglomerates with massive budgets—Temu, Shein, Amazon, and legacy brands—are bidding on the same eyeballs as the teenager in his bedroom. This competition has driven ad costs vertically.

Let’s look at the Unit Economics of a typical 2025 failure:

- Sale Price: $50.00

- Cost of Goods Sold (COGS): $15.00 (Product + Shipping)

- Transaction Fees (Stripe/Shopify): $2.00

- Gross Margin: $33.00

This looks healthy on paper until you factor in the ads. In 2025, the average CPA (Cost Per Acquisition) on Meta or TikTok for a cold-traffic impulse buy often hovers between $25 and $35.

- Ad Spend (CPA): $30.00

- Net Profit: $3.00

A $3.00 net profit on a $50.00 sale is a 6% margin. This is razor-thin. It leaves zero room for returns, chargebacks, customer service software, or taxes. One unhappy customer wipes out the profit of ten successful orders. The dropshipper is no longer a business owner; they are essentially an unpaid employee of Meta and Google, funneling all their margin directly into Mark Zuckerberg’s pocket in exchange for traffic.

The “Temu Effect” and Consumer Sophistication

For years, dropshippers relied on Information Asymmetry. They relied on the customer not knowing that the “Galaxy Projector” selling for $60 was available on AliExpress for $8.

That veil of ignorance has been lifted. The aggressive expansion of direct-to-consumer marketplaces like Temu, Shein, and AliExpress has retrained the global consumer. In 2025, the average shopper is digitally savvy. When they see an interesting gadget on Instagram, they do not click “Buy Now.” They take a screenshot, run it through Google Lens or Amazon Image Search, and find the source within ten seconds.

If you are selling a generic product that can be found cheaper on Amazon (with 2-day delivery) or Temu (with 90% lower pricing), you have no value proposition. You are charging a “middleman tax” that the market is no longer willing to pay. The dropshipper adds no value to the product—no branding, no custom packaging, no improved engineering—and therefore, they cannot command a premium price.

The Cash Flow Trap: The Silent Killer

While ad costs and competition garner the headlines, the silent killer of dropshipping businesses is Cash Flow Latency.

In a traditional dropshipping model, you get paid by the customer today, and you pay the supplier immediately to ship the product. However, payment processors like Stripe and PayPal have become incredibly risk-averse regarding the dropshipping business model due to high fraud rates and long shipping times.

It is standard practice in 2025 for payment processors to place “Rolling Reserves” on new dropshipping accounts. They might hold 25% to 50% of your revenue for 90 days to cover potential chargebacks. Here is the nightmare scenario: You scale a winning product. You do $10,000 in sales in a week. You need $4,000 to pay your supplier to ship those orders. But Stripe is holding $5,000 of your revenue. You don’t have the cash to fulfill the orders. You delay shipping. Customers get angry and chargeback. Stripe sees the chargebacks and bans your account. The business implodes, not because it wasn’t profitable, but because it was illiquid.

The Pivot: From “Dropshipper” to “Brand Owner”

Does this mean e-commerce is dead? Absolutely not. E-commerce is growing. But the low-effort dropshipping model is dead. The entrepreneurs who are succeeding in 2025 have abandoned the “churn and burn” product testing strategy in favor of Vertical Integration and Asset Building.

The successful pivot involves three key strategies:

1. High-Ticket Dropshipping (The Margin Sanctuary): Smart operators have moved away from selling $30 gadgets. They are selling $2,000 electric fireplaces, $4,000 saunas, or $1,500 industrial equipment. When you sell a $2,000 item with a 20% margin, you make $400 gross profit. If it costs you $100 in ads to acquire that customer, you still have $300 in profit. The high ticket price insulates you from rising ad costs. Furthermore, these products are rarely bought on impulse, meaning the customers are less likely to return them, and the competition from Temu is non-existent.

2. The “Drop-Surge” to Private Label Pipeline: The new methodology is to use dropshipping only for data collection. You test a product. If it sells, you immediately contact a manufacturer to white-label it (add your logo, improve the packaging, fix a product flaw). You then import a small batch to a local fulfillment center (3PL). By shipping locally, you cut delivery times from 15 days to 3 days. By branding the product, you increase the perceived value. This allows you to build a Brand Asset—something that has repeat customers and can eventually be sold for a multiple of revenue.

3. Digital Goods (The Infinite Margin): Finally, many are leaving physical goods entirely. As discussed in previous analyses, digital products (software, templates, courses) have zero Cost of Goods Sold. If you sell a $50 digital guide, and your ad cost is $30, you keep $20. There is no shipping, no supplier to pay, and no inventory to manage. The margin for error is significantly wider.

The Reality Check

The dream of “getting rich quick” by acting as a lazy middleman is over. The market efficiency of 2025 has corrected that anomaly.

However, the dream of building a legitimate online business is very much alive. It just requires more than a Shopify subscription. It requires understanding that you must add value to the transaction. Whether that value is through better curation, faster shipping, superior branding, or expert customer support, you must give the customer a reason to buy from you. The dropshippers failing in 2025 are the ones who are still trying to play the game by the rules of 2017. The ones succeeding are the ones who have stopped playing “business” and have started building one.