Crypto is one of the most misunderstood areas when it comes to side hustles. For some, it represents unlimited opportunity and financial freedom. For others, it’s pure speculation disguised as innovation. The reality, as usual, sits somewhere in between.

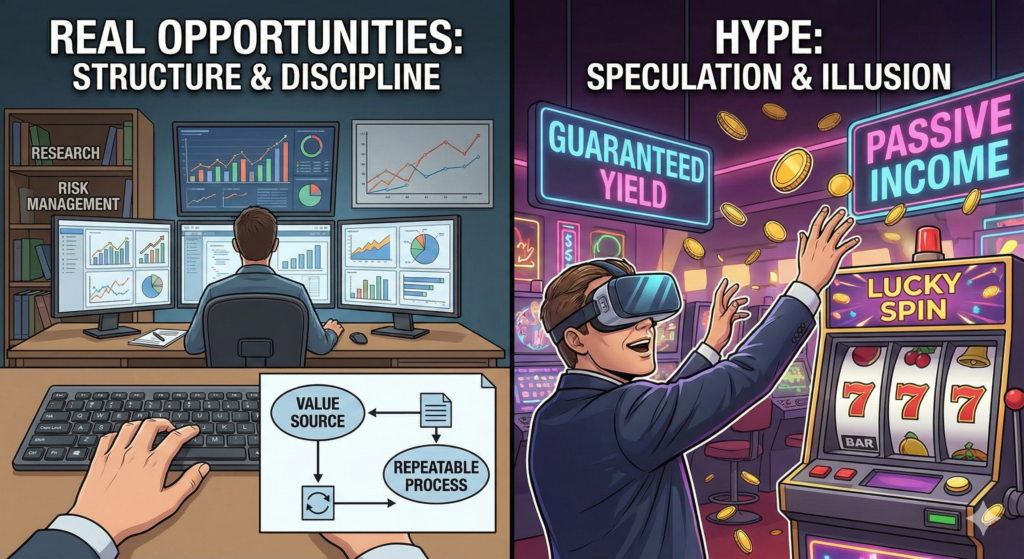

Crypto can support legitimate side hustles — but only if you clearly separate real opportunities from marketing-driven hype. Failing to do so is the fastest way to lose both time and capital.

This article focuses on making that distinction clear.

Why Crypto Attracts So Much Side Hustle Hype

Crypto naturally attracts side hustle seekers for three reasons:

- Low barriers to entry

Anyone with an internet connection can participate. No credentials, no gatekeepers. - High upside narratives

Stories of extreme returns dominate headlines and social media, even though they represent edge cases rather than norms. - Complexity that hides risk

Many crypto products sound sophisticated enough to discourage critical questioning, especially from newcomers.

From experience, this combination creates an environment where perceived opportunity often exceeds actual probability of success.

What Makes a Crypto Side Hustle Legitimate?

A real crypto side hustle shares the same foundational traits as any other legitimate hustle:

- A clear value source

- A repeatable process

- Defined risks

- Rules for capital allocation and loss control

If an opportunity can’t clearly explain where returns come from and what could go wrong, it’s not a side hustle — it’s speculation.

Real Crypto Side Hustle Categories

Let’s break down the main crypto-related side hustles that can be considered legitimate under the right conditions.

1. Active Trading Strategies

Trading is one of the most common crypto side hustles — and also one of the most misunderstood.

Why it can work:

- High liquidity

- Volatility creates opportunity

- Capital-based scalability

Why it often fails:

- Emotional decision-making

- Overtrading

- Lack of defined risk limits

From experience, trading only becomes a real side hustle when it’s treated as a rules-based system, not a reaction to price movements. Without predefined entry, exit, and risk parameters, trading quickly turns into gambling.

Trading is not passive, not easy, and not forgiving.

2. Yield Generation and Staking

Yield-based strategies are often marketed as “passive income,” but that label is misleading.

Legitimate yield strategies involve:

- Understanding protocol mechanics

- Assessing counterparty and smart contract risk

- Monitoring changing conditions

Common pitfalls:

- Chasing unsustainable APYs

- Ignoring protocol incentives and token emissions

- Underestimating tail risk

In practice, yield generation works best as a capital preservation-first strategy, not a yield-maximization game. Sustainable returns tend to look boring — which is exactly why they last.

3. Arbitrage and Market Inefficiencies

Crypto markets are fragmented, which creates arbitrage opportunities.

Why arbitrage can be a valid side hustle:

- Price discrepancies are measurable

- Risk can be structured

- Execution can be automated

Limitations:

- Requires technical setup

- Margins shrink over time

- Competition increases quickly

Arbitrage is one of the few crypto hustles where returns come from market structure, not speculation. However, it’s best suited for people with technical or quantitative skills.

4. Infrastructure and Service-Based Crypto Hustles

Not all crypto side hustles involve deploying capital.

Examples include:

- Analytics tools

- Educational content

- Community management

- Research and due diligence services

These hustles combine traditional skill-based models with crypto-native demand. From a risk-adjusted perspective, they are often more sustainable than capital-heavy strategies.

They also benefit from skill compounding rather than market timing.

Where the Hype Usually Lives

Most crypto side hustle hype concentrates in predictable areas.

“Guaranteed” High-Yield Products

Any product advertising fixed or guaranteed returns in crypto should immediately raise concerns. Markets are volatile by nature. Guarantees usually imply hidden risk.

Fully Passive Systems

Bots, copy-trading platforms, and automated strategies are often marketed as hands-off income. In reality, automation does not remove risk — it concentrates it.

Neglect is one of the most common causes of failure in these systems.

Early Access and Insider Narratives

Private deals, “alpha groups,” and insider tips rely more on exclusivity marketing than repeatable value creation. Some work briefly. Most don’t scale or last.

Risk Management Is the Real Skill

In crypto side hustles, risk management matters more than strategy selection.

Key principles that consistently matter:

- Position sizing

- Diversification

- Liquidity awareness

- Exit planning

From experience, people rarely lose everything because they chose the “wrong” idea. They lose because they allocated too much capital to a single outcome. Therefore, to avoid loss, it is necessary to learn how to correctly choose the right side hustle and learn to avoid the common Side Hustles mistakes.

Survival is the first objective. Growth comes second.

Active Involvement Is Non-Negotiable

Crypto changes fast. Protocols evolve, incentives shift, and market conditions reverse without warning.

A crypto side hustle requires:

- Continuous learning

- Periodic reassessment

- Willingness to reduce exposure

Anyone looking for “set and forget” income is better served elsewhere.

Crypto Side Hustles vs. Traditional Side Hustles

Compared to traditional hustles:

- Crypto offers higher leverage

- Returns are less predictable

- Losses are more visible and immediate

This doesn’t make crypto better or worse — just different.

In my experience, crypto side hustles work best as part of a broader income strategy, not as the sole focus.

Final Thoughts: Opportunity Without Illusion

Crypto absolutely enables real side hustles. But the opportunity lies in structure, discipline, and realism, not hype.

The people who succeed long-term are rarely the ones chasing the highest returns. They are the ones who understand risk, manage exposure, and stay adaptable.

A crypto side hustle is not about getting rich quickly. It’s about building a system that survives volatility and compounds over time.

Once you remove the illusion, what remains is still powerful — just far more demanding than most marketing would have you believe.